1. Founders looks for VCs as reliable partners with tangible value add

Atomico asked founders what their most important considerations were when selecting an investor to lead their next round; they also asked VCs what they thought allowed them to win competitive deals this past year. The results were quite different.

Founders are looking for a reliable business partner that understands the business they are building and can provide tangible value add.

Contrary to Founders, VCs value early relationship building, as this enables them to track how a company develops over time and as way to maintain the option to invest in future funding rounds.

2. A new generation of angels

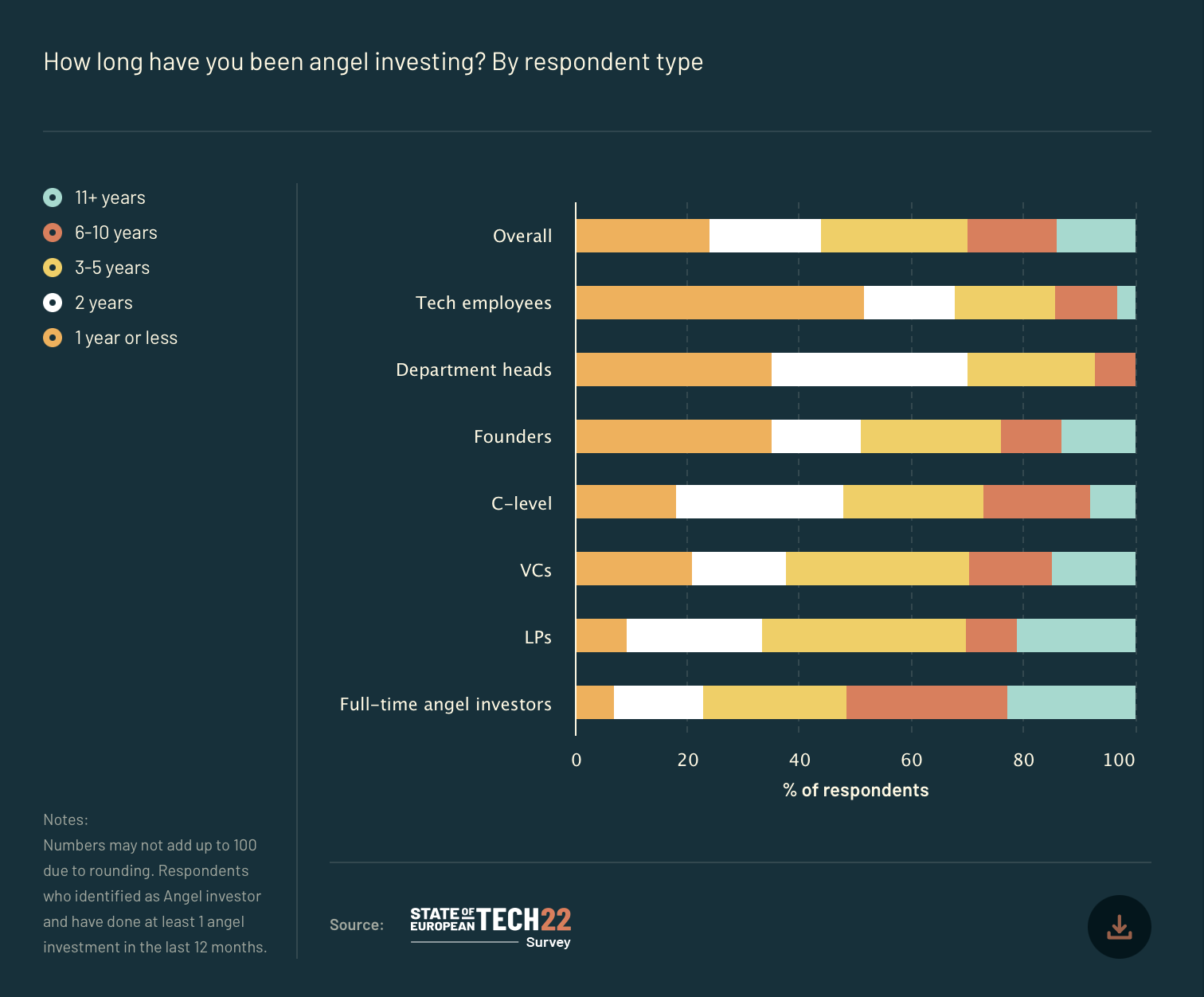

The growing prevalence of angel investing within the European tech ecosystem is also evident in the share of employees at tech companies undertaking this activity.

Survey responses clearly highlight how operators at all levels (C-Level, heads of departments and employees) are being drawn into backing new founders and companies, many of whom only started in the past one or two years.

This is a trend that is observable across all types of survey respondents, including amongst institutional investors from VCs and LPs too.

3. Angels driving diversity

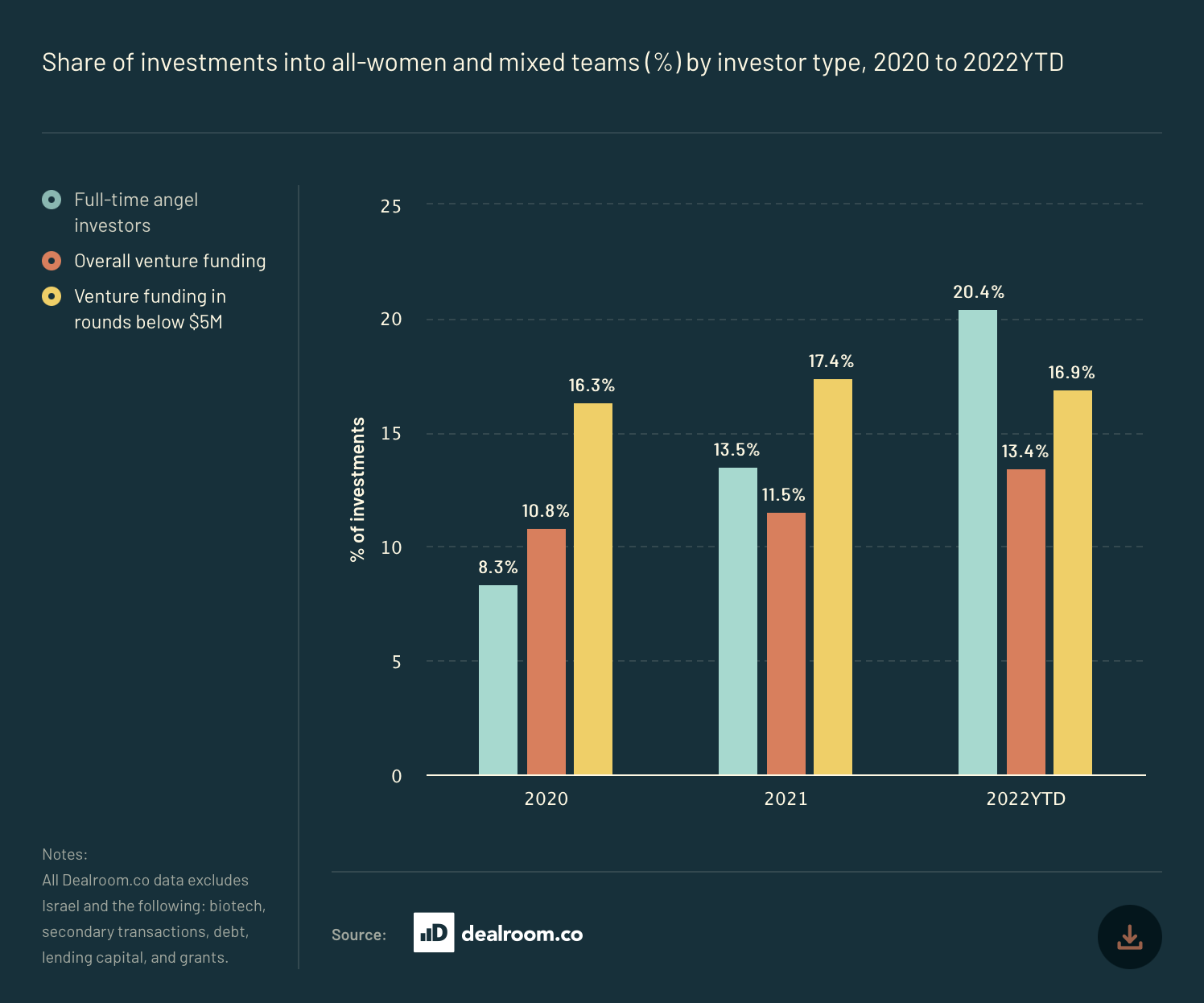

While a number of initiatives and funds exist at the earliest stage to support a more diverse set of founders, there is still work to be done amongst angel investors too.

They are performing better on team diversity than the share of overall funding. However, they have actually taken longer to catch up if we look at the share of capital going to mixed and all-women teams raising rounds of less than $5M - a closer comparable to the types of rounds they are involved in.

4. Angels' power

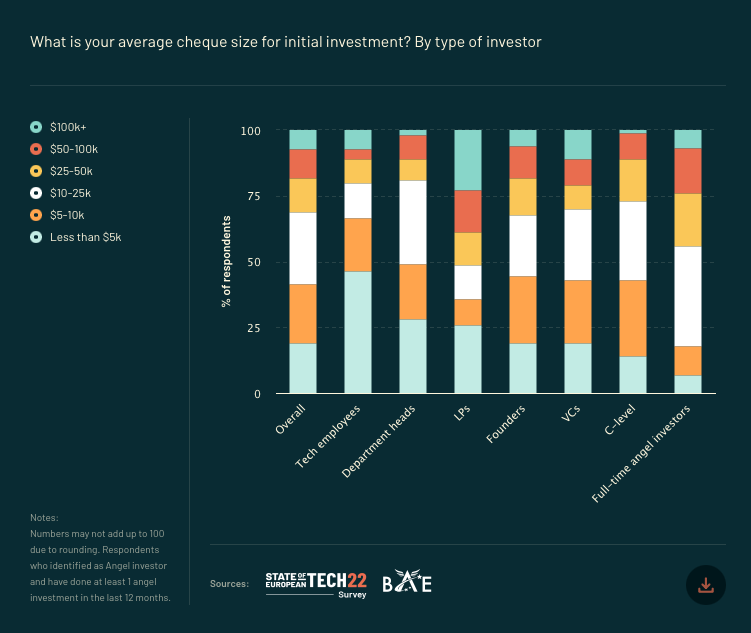

There are a wide range of survey respondents across the European tech ecosystem with varying firepower to invest. 46% of tech employees are investing less than $5K on average for initial investment. The majority of respondents invest anywhere between $5-25K per investment.

There are other angel networks where participants are able to write bigger size checks. Business Angels Europe ("BAE") network is made up of 19 BAE clubs across Europe, with around 200 members per club. The average investment size across their networks stands at $250K.

5. The importance of angels

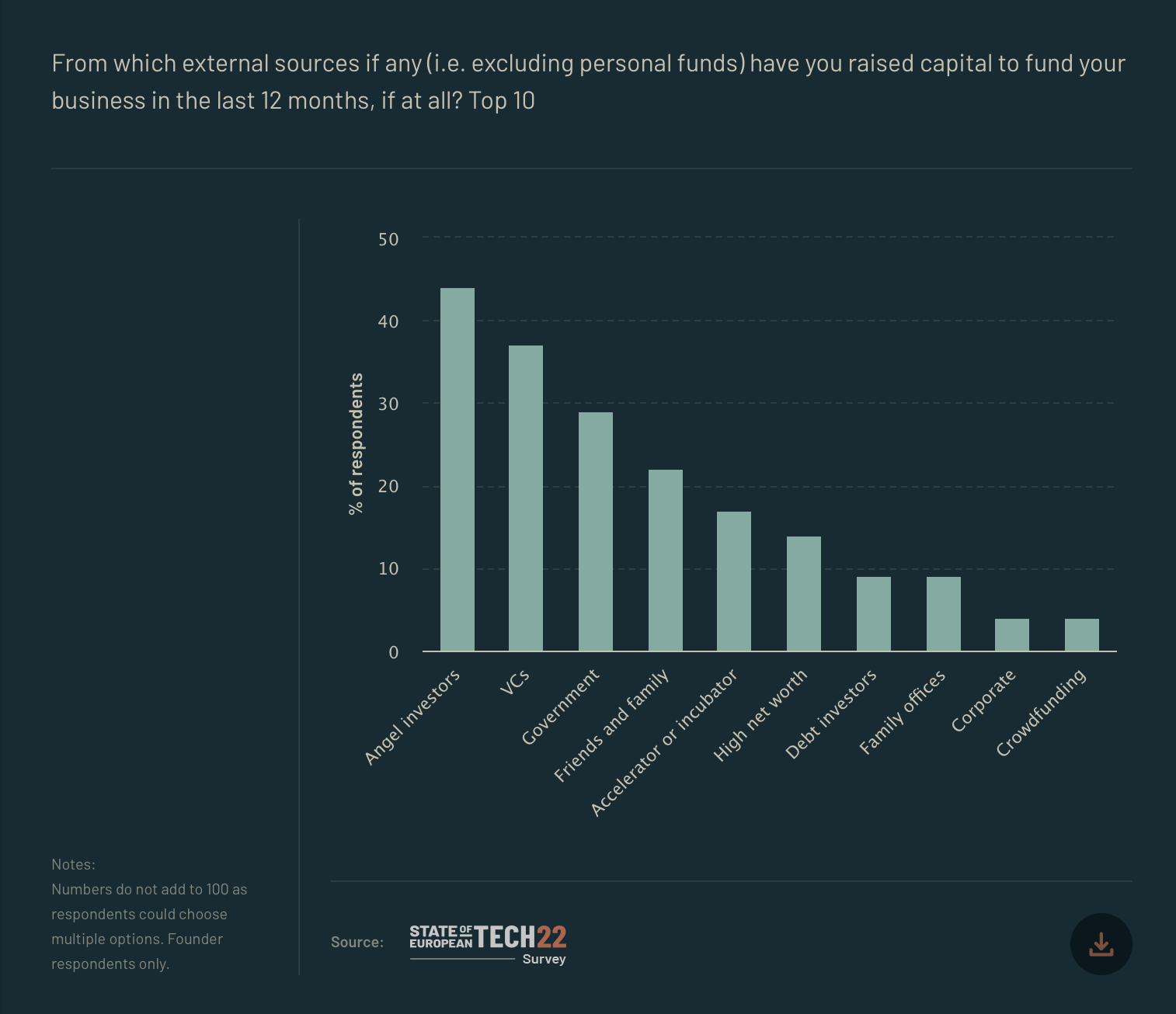

Angels are vital to the European ecosystem. Almost half of founders - 44% - reported raising capital from angels in 2022, compared to only 37% raising from VCs.

Standing as often the first point of entry to founder funding, angels act as early ambassadors, finding founders and providing the bridge they need to the overall funding ecosystem.

Read the full Atomica report here.